are funeral expenses tax deductible in 2020

Custodial fees are tax-deductible under certain conditions. This applies only to.

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

Qualified medical expenses must be used to prevent or treat a medical illness or condition.

. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Were sorry for your loss. Click to see full answer.

Funeral Expenses Payment also called Funeral Payment to help pay funeral costs if you get certain benefits - eligibility how to claim form SF200 2. If the decedents estate was large enough to be subject to federal estate tax then these costs are deductible on the estate tax return Form 706. The IRS deducts qualified medical expenses.

In this regard can I deduct funeral. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. According to the IRS website only medical expenses are tax deductible for individuals not the funeral or burial costs.

Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. We sold our second home and took a loss. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which is the federal estate tax return.

The IRS allows deductions for medical expenses to prevent or treat a medical illness or condition but not funeral or cremation costs. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. No never can funeral expenses be claimed on taxes as a deduction.

This includes government payments such as Social Security or Veterans Affairs death benefits. The exemption is portable for married couples. If you itemize your deductions and your miscellaneous expenses exceed 2 percent of your adjusted gross income you can deduct your custodial fees.

This cost is only tax-deductible when paid for by an estate. Is a funeral a write off. However if your estate is below the.

These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. If the estate was reimbursed for any of the funeral costs you must deduct the reimbursement from your total expenses before claiming them on Form 706. The threshold for filing a federal estate tax return is 114 million for a decedent dying in 2019 and 1158 million for a decedent dying in 2020.

This means that you cannot deduct the cost of a funeral from your individual tax returns. Estates worth 1158 million or more need to file federal tax returns and only 13. Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the executor of the estate must file an estate tax return and itemize the expenses in order to claim the deduction.

But for estates valued above 114 million in 2019 or 1158 million in 2020 deducting funeral expenses on the estates Form 706 tax return would result in a tax saving. Such reimbursements are not eligible for a deduction. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses.

Individuals cannot deduct funeral expenses on their income tax returns. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses.

Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the executor of the estate must file an estate tax return and itemize the expenses in order to claim the deduction. Individual taxpayers cannot deduct funeral expenses on their tax returns. Qualified medical expenses include.

In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. Can you claim funeral expenses on your taxes in Canada.

Are funeral expenses tax deductible for 2020. The information in this article is up to date through tax year 2019 taxes filed in 2020. Because the amount of the gross estate did not exceed the federal.

Individual taxpayers cant deduct funeral or cremation expenses on their federal tax returns but if the deceased person has an estate worth over 11M then the estate can claim deductions for certain costs. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. How to file funeral deductions for estates.

Taxes 2020 Found insideclosed on December 17 2020. Individual taxpayers cannot deduct funeral expenses on their tax return. While the IRS allows deductions for medical expenses funeral costs are not included.

IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one. Funeral Costs Paid by the Estate Are Tax Deductible While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes the estate of your loved one can take a deduction on these costs. Liberalized educator expense deduction.

Funeral expenses when paid by the decedents estate may be taken as a deduction. Individuals cannot deduct funeral expenses on their income tax returns. Funeral expenses are not tax deductible because they are not qualified medical expenses.

In other words our own funeral expenses are not deductible on Form 1040 but if we work hard enough or hit the lottery they may be deductible for our estate on Form 706. Deductible medical expenses may include but are not limited to the following. While individuals cannot deduct funeral expenses eligible estates may be able to.

In short these expenses are not eligible to be claimed on a 1040 tax form. The Internal Revenue Service IRS sets strict rules about what expenses can and cannot be deducted from your tax bill. Alternatively tax deductions do exist for the estate of a deceased individual.

You may not take funeral expenses as a deduction on a personal income tax return. This means that you cannot deduct the cost of a funeral from your individual tax returns. Funeral expenses arent tax deductible for individuals and theyre only tax exempt for some estates.

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible It Depends

Funeral Expenses Tax Deductible Ato Best Reviews

Canada Revenue Agency Tax Tip Eight Things To Remember At Tax Time Lifestyles Thesuburban Com

Tax Deductions On Medical Expenses In 2020 Caribou

Funeral Expenses Tax Deductible Ato Best Reviews

Are Funeral Expenses Tax Deductible It Depends

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible It Depends

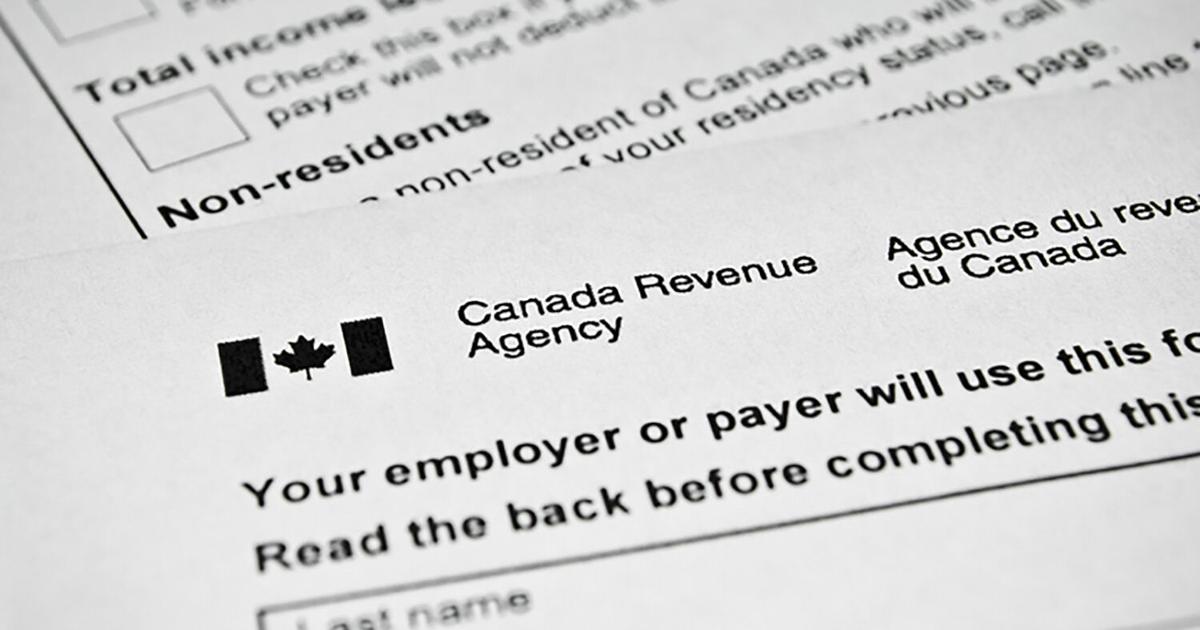

-Chris-Valardo-rv6NmSwSbL7zGWK69.png)

Business Owners Building Wealth Protecting Legacies Atlantic Wealth Management

City Of Chelsea Massachusetts Gov 𝐂𝐡𝐞𝐥𝐬𝐞𝐚 𝐅𝐮𝐧𝐞𝐫𝐚𝐥 𝐅𝐮𝐧𝐝 For The Dignity Of Loved Ones Who Have Passed The Chelsea Funeral Fund Provides Up To 1 700 In Financial Assistance For Cremation Or

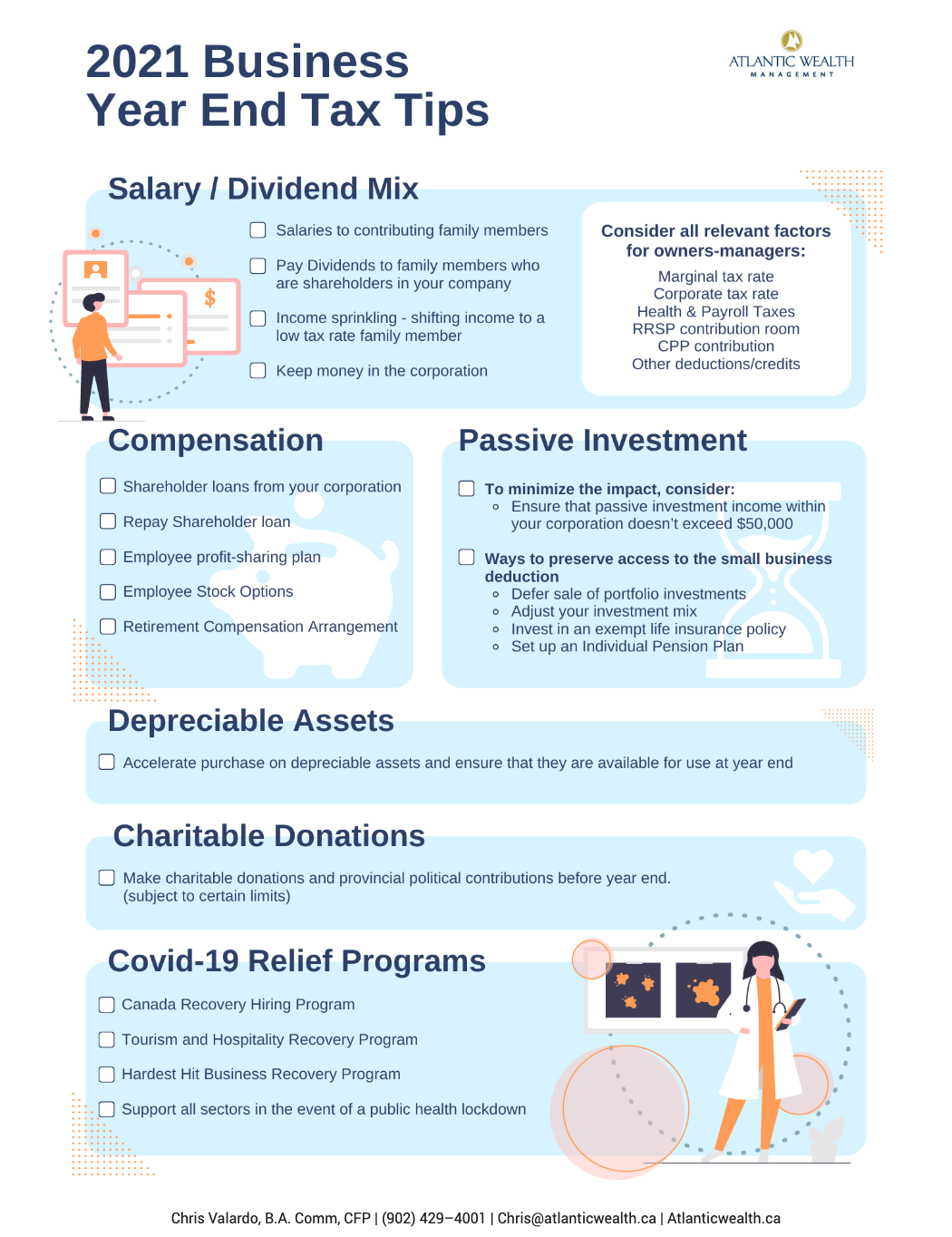

Business Owners 2020 Tax Planning Tips For The End Of The Year Wilson Insurance And Financial

Are Funeral Expenses Tax Deductible It Depends

Funeral Expenses Tax Deductible Irs Best Reviews

Are Funeral Expenses Tax Deductible It Depends

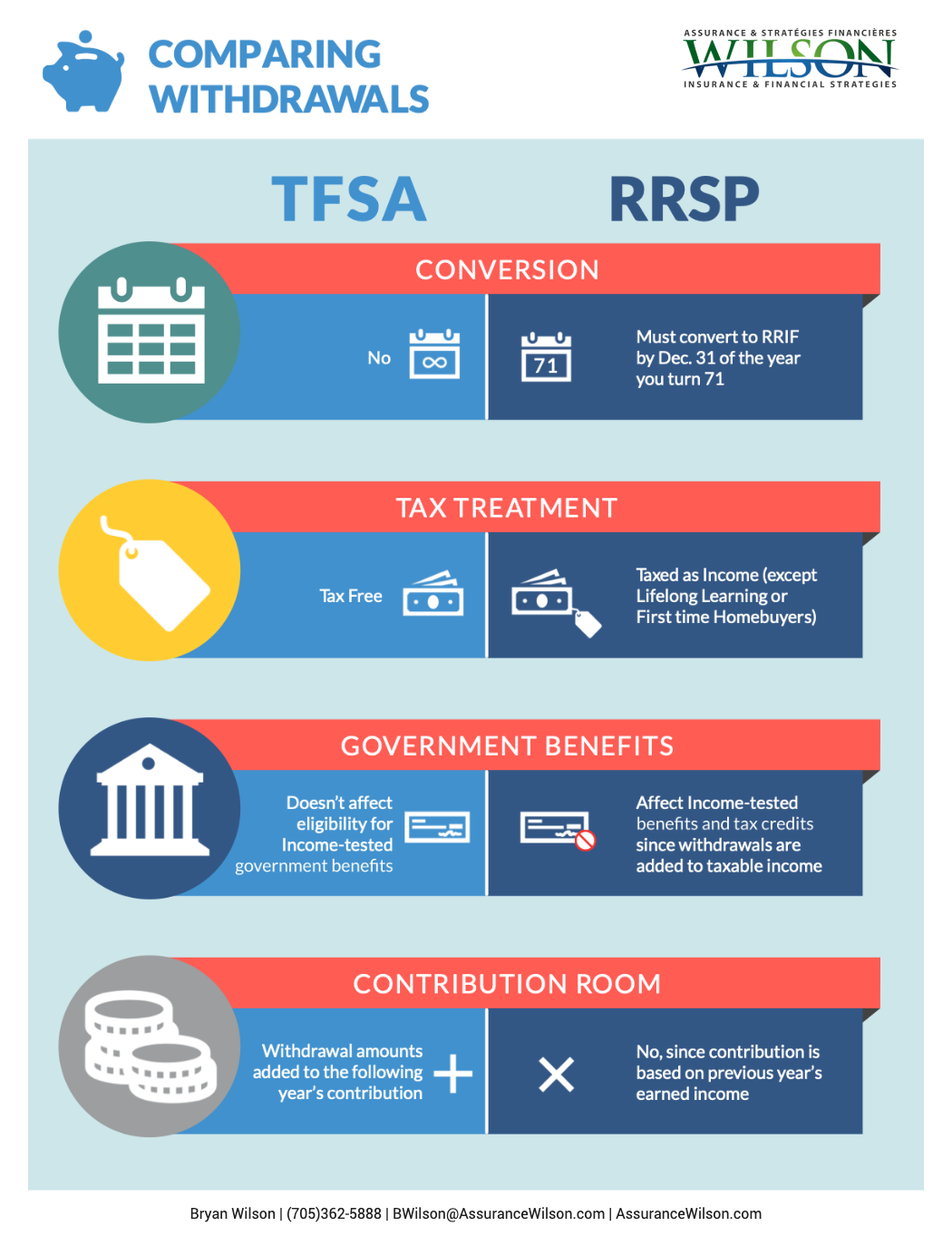

Tfsa Vs Rrsp What You Need To Know To Make The Most Of Them In 2021 Wilson Insurance And Financial

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com